By aftermarketNews.com staff

By aftermarketNews.com staff

As gas prices remain high this summer driving season, Honeywell Turbo Technologies says it is working with auto manufacturers to meet the increase in demand for affordable and fuel-efficient downsized turbocharged engines.

Honeywell estimates the number of turbocharged commercial and passenger vehicles sold in North America is projected to reach 3.2 million in 2012, up from 2.2 million in 2011. Passenger vehicles alone account for nearly 850,000 additional turbo engines, that’s a 61 percent increase from 2011, according to Honeywell.

"With fuel prices being a significant concern for consumers and businesses, turbochargers are a smart choice for getting more miles to the gallon," said Tony Schultz, vice president for the Americas, Honeywell Turbo Technologies. "It’s a proven technology that can be used across market segments and does not put the consumer in an extended payback period like other technologies to realize its benefits. Turbocharging technology has been a fuel economy driver for decades in the United States for the on- and off-highway commercial vehicle market, as well as in global passenger vehicle markets like Europe."

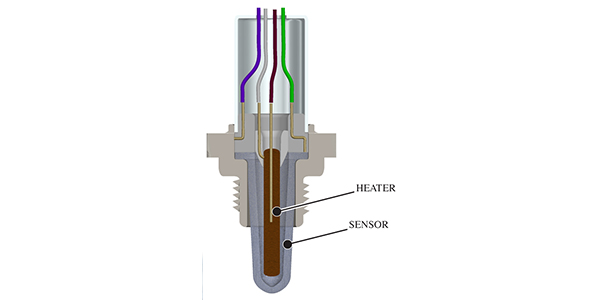

Honeywell says it has a global portfolio of turbocharging technologies available for vehicles in virtually every segment. These technologies are a key enabler for replacing larger naturally aspirated engines by downsizing to a smaller turbocharged engine with improved fuel economy and equal or better performance. A turbocharger uses exhaust gases that otherwise would be wasted to increase air flow into the combustion chambers providing big engine power performance with small engine efficiency and reduced emissions.

Data shows a steady decline since 2008 in large 8-cylinder engines and an increase in 4-cylinder engines as U.S. consumers downsize to smaller engines and engines with turbochargers because of higher gas prices, according to J.D. Power and partner firm LMC Automotive. Turbochargers were fitted in only 2% of gasoline or flex-fuel vehicles produced in the United States in 2008, but that figure jumped to 9.5% in 2011 and is expected to more than double to 23.5% in 2017, LMC Automotive predicts.

In a recent report, the EPA cited turbocharging as one technology helping explain "the improvements in CO2 and fuel economy during the last seven years" by making engines more efficient and allowing automakers to shift to smaller engines. A smaller turbocharged engine can provide a 20% to 40% fuel economy improvement and deliver the same performance as a larger engine. Industry data illustrates the ongoing downsizing trend as the average engine size in North America is decreasing from 3.6L in 2007 to a projected average of 2.9L by 2016.

Turbocharged automobiles, such as Ford’s EcoBoost lineup and the Chevrolet Sonic and Chevrolet Cruze have been among the best-selling vehicles in the U.S. this year. The Cruze Eco and Sonic, which both offer Honeywell turbocharged engines among its models, can deliver 40 miles per gallon or higher on the highway and have starting prices below $20,000.

Each year Honeywell launches, on average, 100 new turbo applications globally. Currently, Honeywell has more than 500 programs with nearly every major global manufacturer in its product development pipeline. The 2013 Dodge Dart, set to be released later this year, will also feature a fuel-efficient Honeywell turbocharged engine. Honeywell turbochargers also boost the Fiat 500 Abarth and diesel models of the Chevrolet Silverado and Volkswagen Touareg.